How Is Family Trust Different From Real Estate Trust

When someone hears the word "Trust" - in that location are usually certain images that come to heed. Things like "wealthy trust fund babies" and elderly individuals with high net worths, to proper noun a few. The truth is, yet, more than people benefit from having a Trust than you probably think.

If you're looking for the all-time, nigh comprehensive way to protect your family after yous're gone (and yous're a homeowner with at least $160,000 of avails) a Trust will likely be the ideal Estate Programme option for you. Creating your Volition is another protective measure you tin can accept to safeguard your assets and loved ones if you're not quite ready or don't even so qualify for a Trust. And don't worry — you lot can e'er add a Trust to your Estate Program equally your life evolves.

In short, a Trust is a fiduciary agreement that'southward function of an Estate Plan. Traditionally, Trusts are used to hold avails for 1 or more Beneficiaries, and they may offer significant estate revenue enhancement and other protective benefits. If you're considering setting up a Trust — or any blazon of Manor Programme for that matter — our guide is the right identify to start.

Not certain which blazon of Manor Program will all-time run into your needs? Take our simple quiz to detect the perfect fit. If you'd still like to acquire more about Trust, keep reading to detect:

-

What is a Trust?

-

What is the purpose of a Trust?

-

Who should have a Trust?

-

Types of Trusts

-

Revocable vs. Irrevocable Trust

-

What to add to a Trust

-

How to proper noun a Trust

-

How to fund a Trust

-

Other common questions about Trusts

What is a Trust?

A Trust is a legal fiduciary arrangement that allows you to set up your avails to be held and managed by a third party. This party is known as a Trustee, and the person or firm you engage to this role will be responsible for ensuring that your estate is handled in the way you lot've outlined.

Despite what many people remember, Trusts tin can be beneficial for all sized-estates, not just very large ones. There is a common misconception that an Estate Planning Trust is just suitable for the extremely wealthy. Just the reality is, in that location are many benefits to a Trust, including:

-

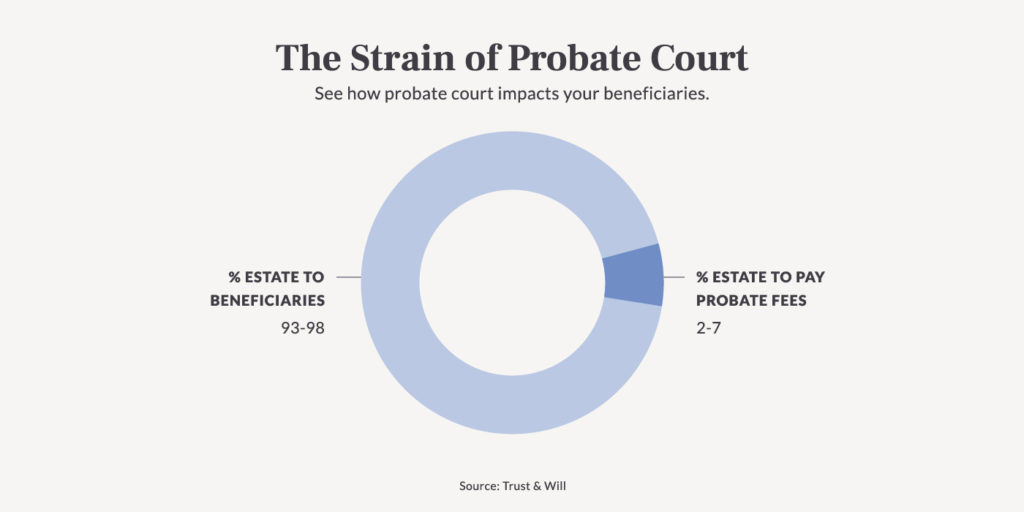

Avoiding probate court so Beneficiaries tin receive assets sooner

-

Privacy

-

Protection

-

Reduced or eliminated estate and gift taxes

-

The ability to better-control future wealth past establishing conditions for asset-distribution

In that location are multiple types of Trusts, and it's important to actually assess your needs and goals earlier you determine on which type you'll create. Nosotros'll discuss in more detail the types of Trusts below.

What is the Purpose of a Trust?

There are several purposes of an Estate Planning Trust, merely i of the more than common reasons people choose to use them is to better-ensure their assets are handled exactly as they wish, from the moment the Trust goes into upshot, until long after passing. They tin also exist used as a means to manage taxation consequences on an estate. And, they're a way to potentially protect your wealth while still qualifying for Medicaid in your afterward years.

Trusts are often used in cases where someone wants or needs to prepare up financial care for young children or long-term planning and care for dependents with disabilities.

Who Should Have a Trust?

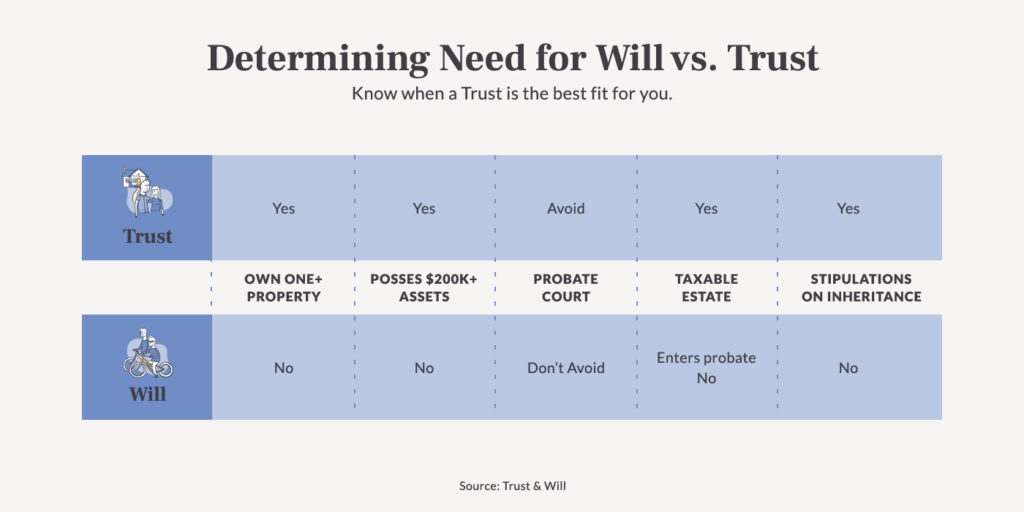

Trusts aren't necessarily the best solution for everyone. There are several reasons a Trust might make sense, but that doesn't mean admittedly everybody needs one. A Trust may be beneficial for those in specific situations, such as:

-

You lot ain a domicile or other property, specially if information technology'southward out of state

-

You accept $200k+ in assets

-

Yous wish to keep your assets private

-

You are hoping to simplify the probate process for your loved ones after you pass

-

You accept a taxable estate – keep in mind the qualifying value that deems an estate "taxable" will differ from state to state

-

You want to set upward stipulations on inheritances – for example, awarding a dollar amount for sure life events such every bit graduating college, getting married, etc.

Types of Trusts

As noted, there are several types of Trusts, each with its own nuance and purpose. Before establishing a Trust, exist sure to have a clear idea of your goals so you can use the blazon of Trust best-suited to achieve them.

Living Trust

A Living Trust is created during your lifetime and it designates a trustee who will manage assets for your Beneficiary or Beneficiaries after your passing.

Revocable Living Trusts

A Revocable Living Trust is created during your lifetime and tin can be altered or revoked while yous're alive. Information technology is used to avert probate, but while you're alive, it's not an ironclad technique for asset protection. Whatever assets in your Revocable Living Trust will however exist available to creditors during your lifetime, although it will be more difficult for them to gain admission.

Irrevocable Trusts

An Irrevocable Trust means you cannot change or change anything in the Trust in one case information technology'southward established. You lot accept legally removed whatever rights to ownership to anything you put in the Trust. In some cases, an Irrevocable Trust may be used equally a style to protect assets from creditors or bypass estate tax, as you lot will have effectively removed yourself as owner for any of the assets inside the Trust. Irrevocable Trusts can be benign for those in professions that are vulnerable to lawsuits, such equally attorneys or doctors.

Articulation Trusts

A Joint Trust is a Trust established for two people, like husband and wife. While both parties are alive, they maintain full control over whatsoever and all avails that are in the Trust. They can modify the Trust at whatsoever fourth dimension, and after one partner passes, the surviving partner becomes Trustee.

Testamentary Trusts

A Testamentary Trust is a Trust that's created within a Will, and it simply goes into result upon your passing. Likewise known as a "Trust Under Will" or a "Will Trust," the Final Volition and Testament instructs how the actual Trust should be established. Considering the Trust isn't truly created until after y'all pass, information technology'southward not considered a Living Trust. It's important to note that this option results in the Will going through probate. And, there'south also diminished privacy protection that some Trusts offering, as the Trust terms are described in the Will.

Revocable vs Irrevocable Trust

A Revocable Trust can be changed at any bespeak during your life equally long as you're of sound mind. By contrast, an Irrevocable Trust is the exact opposite. It cannot exist changed, and furthermore, you no longer own assets one time you place them into an Irrevocable Trust. It may seem like an Irrevocable Trust is never a good idea, but under certain circumstances, it actually tin can exist beneficial. For example, if you are at risk for lawsuits due to your profession, an Irrevocable Trust can protect and preserve your assets from judgments, creditors and liens.

What to Add together to a Trust

There are certain assets that are appropriate to fund your Trust. To attain this function of the process, y'all will retitle avails with the Trust equally the owner. The types of assets a Trust can hold include:

-

Home(s) or other real estate

-

Tangible property like jewelry, antiques, collectibles, vehicles, etc.

-

Retirement accounts – naming the Trust as beneficiary

-

Brokerage accounts and non-retirement investments can be retitled in your Trust'south name

-

Cash accounts, including savings and checking accounts, money markets and CDs – note that transferring CDs needs to be handled advisedly and so you're non penalized for an early on withdrawal of funds during the retitling process

-

Large assets

-

Business interests

-

Stocks or bonds that are held in document class

-

Non-qualified annuities

How to Name a Trust

Choosing a proper noun for your Trust is the easy, but important office. Most people name a Trust something logical and representative of their family. This makes sense, as it makes information technology easy to remember, and so when you're renaming all the assets the Trust will agree, it'due south a logical process. Your family unit proper name (and mayhap the date the Trust is established), along with the words "Family Trust" at the end, is a uncomplicated formula that's commonly used. Using this format or something similar to information technology leaves very fiddling room for any misinterpretation as to what the Trust document is. Date can be used as an organizational tool, or information technology can exist left off entirely.

How to Fund a Trust

In one case you have created and named your Trust, the next pace is funding your Trust. Funding a Trust simply means you are moving avails into the Trust, making the Trust the new owner. Keep in heed, your Trust is a vehicle designed to hold and protect your assets. Until y'all put said assets into information technology, it actually holds no value or has any purpose. At that place is a pretty straightforward process to motion advisable assets into a Trust. Much of information technology just involves renaming an asset to be Trust-owned.

Private assets tin can accept slightly unlike processes, so be certain to check each 1. For example, to put existent estate into your Trust, you lot will need the act, and if yous have a mortgage on the belongings, it'southward possible, just not likely, that yous might need permission from your lender. If you're transferring banking company accounts into your Trust, y'all should check with your bank for the specifics on paperwork.

Other Common Questions about Trusts

Differences Betwixt a Will and a Trust

The biggest difference between a Trust and a Will is that a Trust goes into effect equally shortly as it'southward created, whereas a Volition simply becomes effective after you pass. There are also taxation implications specific to each, and Trusts tin can remain private and avoid probate, whereas the process of passing holding per the terms of a Volition will exist both public and go through probate.

What is a Trust Fund?

A Trust Fund is an effective tool that's often used in Manor Planning wherein a Grantor (y'all) sets up a program that volition ensure fiscal stability and security of a Casher, oftentimes a kid or grandchild. A Trust Fund tin can hold investments, greenbacks, existent estate and other assets to be distributed in the future.

What is a Trustee?

A Trustee is the person you name to exist responsible for your Trust assets. In essence, the Trustee is the legal owner of everything in the Trust. He or she is charged with administering (distributing) assets or property for the do good of your named Beneficiaries, as defined in the Trust. The Trustee is as well responsible for handling the Trust'south revenue enhancement filings.

Can a Trustee Be Removed From a Trust?

A Trustee can be removed from a Trust nether sure conditions. For example, if they accept not lived up to the responsibilities outlined in the Trust, if they no longer wish to perform or are incapable of the duties, or as specified in the Trust. You can outline means to remove a Trustee, such as stating all Beneficiaries must agree they want to alter who is appointed.

Tin a Trustee Use Money From the Trust ?

Trustees tin just use the money or avails in the Trust to provide for Beneficiaries or to attain other Trust-related responsibilities. A Trustee cannot use Trust money for personal use or benefit.

What Is An A-B Trust?

An A-B Trust is used to minimize estate taxes. Also known as a Credit Shelter Trust or a Bypass Trust, information technology's a Joint Trust that a husband and wife create together. A-B Trusts will dissever into ii separate Trusts once the commencement partner passes. At that fourth dimension, Trust A becomes what's referred to equally the Survivor'southward Trust, and Trust B is the Decedent's Trust. This blazon of Trust can be tax benign for those with very large estates ($xi.58m or larger) to avoid heavy estate taxes for Beneficiaries. A-B Trusts allow a surviving spouse to use and benefit from Trust avails, but prevents them from changing whatsoever distribution plans. They're often used in circumstances with blended families or remarriages and then that surviving spouses can not get out assets to just their ain children.

Can I Put My Vehicles In My Trust?

Y'all tin can transfer cars to your Trust, but one concern is insurance. Some insurance companies don't take a great arrangement for handling Trusts. That could mean you would demand to name the Trust, Trustees and/or Beneficiaries as "Boosted Insureds," or get special riders from your insurance carrier, which tin can be a hassle. Because of this, some people choose not to put their personal vehicles in their Trust. Instead, they rely on the Cascade-Over Volition to say any vehicles go into their Trust at decease. Letting assets pass under the Volition might mean the Volition has to go through probate, merely the values of the cars are commonly low enough that it'southward just a simplified probate process. Note that this is truthful for daily commuter cars, but collector or valuable cars might be different.

Setting up your Trust is beneficial on many levels. It's i of several layers of your Estate Plan, and it's yet another safeguard against things happening confronting your wishes once you no longer have a say. Providing security, passing on your difficult-earned personal wealth and assets, and setting up a tax-benign estate is one of the best gifts you can leave your heirs. Knowing and trusting that they will be taken care of, even when y'all're not there to do it, is priceless.

Still wondering if a Trust-Based Estate Program is right for you? Take our elementary quiz to help you lot brand that decision!

Source: https://trustandwill.com/learn/what-is-a-trust

0 Response to "How Is Family Trust Different From Real Estate Trust"

Post a Comment